Why Financial Data Powers ML

Most datasets are static snapshots. Financial data? It's alive.

Markets move. Policies shift. Consumers panic. And buried in all that noise are patterns — some obvious, most not. That’s why financial datasets are a goldmine for machine learning: they’re complex, time-based, and high-stakes. Perfect training ground for systems that learn to detect nuance, predict risk, and spot opportunity before it hits the headlines.

Need to forecast quarterly earnings? Estimate inflation trends? Build credit scoring systems? You need financial data — structured, consistent, and dense with signal.

But here’s the kicker: not all finance data is built for ML.

How to Choose the Right Dataset

Before we dive into the list, let’s talk about filters. Because grabbing random CSVs from the internet isn’t going to cut it, especially when millions are on the line.

Here’s what to actually look for when picking financial data for your model:

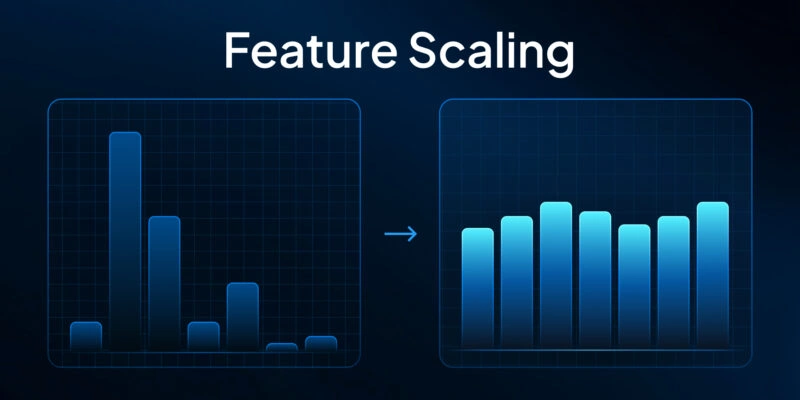

| Feature | Why It Matters |

|---|---|

| Time Resolution | Hourly, daily, quarterly? Match the granularity to your use case. |

| Completeness | Missing rows or backfilled gaps will wreck forecasting accuracy. |

| Domain Fit | Don’t train a credit model on stock data. Seriously. |

| Noise Level | Financial data is messy. But too messy = garbage in, garbage out. |

| Label Availability | Supervised learning needs ground truth — like buy/sell signals or outcomes. |

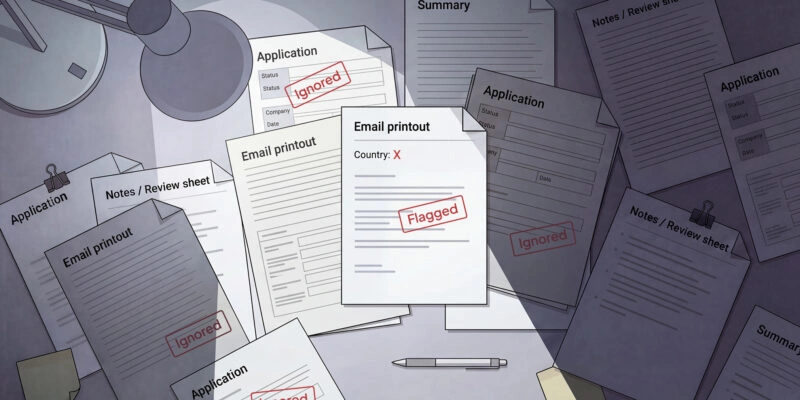

| Licensing | Many financial datasets are behind paywalls or non-commercial licenses. |

| Update Frequency | For real-time use cases, stale data is worse than none. |

You’re not just feeding your model numbers — you’re feeding it context, structure, and assumptions. Choose wisely.

Top 20 Financial Datasets for ML

Grouped by type, cut down to the essentials, and optimized for real-world ML use.

Market & Stock Data

Need to build price predictors, trading signals, or LSTM models that don’t hallucinate? These datasets cover equities, funds, and historical prices — with enough structure to actually train something usable.

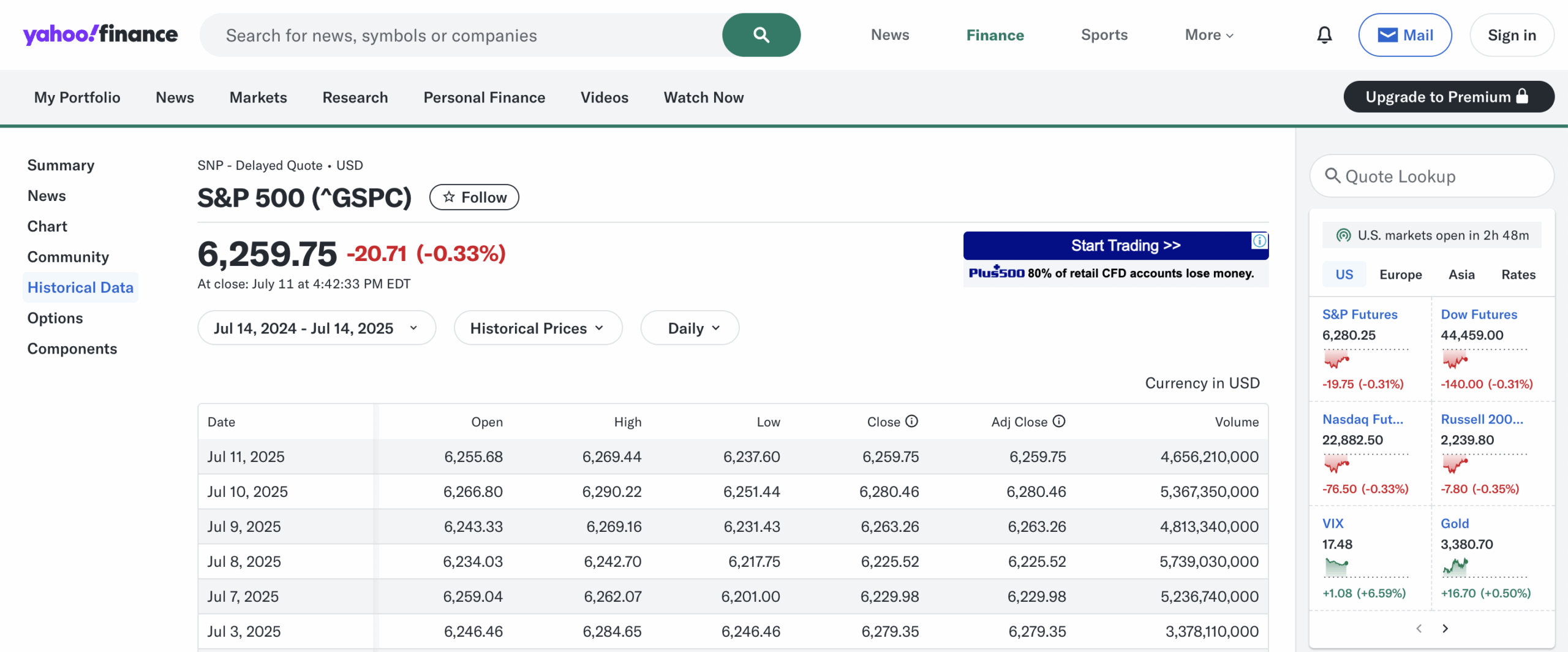

1. Yahoo Finance – S&P 500 Prices

Access: Free (commercial use permitted via wrappers like yfinance)

The classic go-to. Daily OHLCV (open, high, low, close, volume) data for thousands of tickers — including the full S&P 500. It’s clean, updated, and widely supported in tools like yfinance for Python.

Just don’t expect ground-truth labels like “buy” or “sell” — this one’s raw prices only.

Dataset Spotlight (click to expand)

dataset_name: Yahoo Finance – S&P 500 type: Market Data access: Free (commercial use permitted via yfinance) format: CSV via yfinance, JSON via API wrappers ideal_for: LSTM models, trend detection, basic backtesting notes: No labeled targets (raw prices only)

Access: Free tier (commercial use allowed, rate-limited) + Paid plans

A developer-friendly API for financial time series. Pull daily or intraday prices, forex, crypto, and even fundamental metrics with a free key.

Ideal if you need to automate data ingestion or work across multiple asset classes.

3. Quandl – Core US Financials

Access: Freemium (check terms for commercial use of premium content)

Quandl (now part of Nasdaq) offers curated financial datasets including equities, ETFs, and options. Many premium sources — but there’s still a lot for free under the “WIKI” and “FRED” collections.

Perfect for prototyping trading models or economic forecasting.

4. Google Finance via yfinance

Access: Free (commercial use permitted)

Not technically a dataset — but if you’re prototyping in Python, yfinance is the easiest way to get real market data fast. Supports tickers, dividends, splits Smooth integration with pandas

But note: it’s not 100% official or guaranteed to stay stable.

5. Global Financial Data (GFD)

Access: Paid / Academic license required

If you’re into historical backtesting or long-horizon forecasting, GFD is the goldmine. It contains stock prices dating back to the 1800s (!) and even includes discontinued tickers.

Not cheap. But for quant research? It’s unmatched.

Macroeconomic & Banking Data

Stock prices show what traders think. Macroeconomics shows what’s really happening.

If your model needs to understand recessions, inflation swings, or why one country collapses while another thrives — this is where to look.

6. FRED – Federal Reserve Economic Data

Access: Free (commercial & academic use permitted)

This is the backbone of every serious macro model. Over 800,000 time series — from interest rates to unemployment spikes to business cycles — updated by the U.S. Fed itself.

The API is clean, the coverage is vast, and the metadata? Rock solid. If you’re forecasting anything related to the US economy, this is non-negotiable.

Dataset Spotlight (click to expand)

dataset_name: FRED type: Macroeconomic Indicators access: Free (commercial and academic use permitted) format: CSV, JSON via API ideal_for: Inflation modeling, unemployment prediction, macro signals notes: Official U.S. government data, clean and reliable

Access: Free (CC BY 4.0; commercial use permitted with attribution)

Global in scope, surprisingly accessible. The World Bank’s dataset spans GDP, education, trade, climate exposure, and more — all sortable by country, year, or topic.

Perfect for modeling development trajectories or building cross-country comparisons. Just don’t expect minute-level precision — this one’s built for the big picture.

8. IMF International Financial Statistics

Access: Free with registration (CC BY; commercial use permitted)

Want to see how national debts evolve, currencies crash, or inflation explodes? The IMF has you covered. Their dataset is dense, country-specific, and includes rare indicators like reserve positions and fiscal balance sheets.

Not all countries update equally often — but when they do, the detail’s worth it.

Access: Free (commercial use permitted under open license)

Budgets, tax rates, social spending — this is the toolbox for anyone modeling policy impact or building sovereign risk models. It’s especially strong in EU countries and includes time series stretching back decades.

Don’t sleep on this one if your model touches the public sector.

Access: Free (commercial use allowed via EU OGD License)

This is Europe’s official open data firehose. It covers structural funds, economic indicators, regional imbalances — you name it.

The data’s clean, machine-readable, and often fills in gaps you won’t find in World Bank or IMF sources. Great if your model needs subnational nuance.

Crypto & Blockchain Data

Traditional finance moves by quarters. Crypto moves by memes. If your model needs to capture volatility, sentiment, or on-chain behavior, these datasets will teach it how to ride the chaos — not drown in it.

Access: Free tier (commercial use allowed) + Paid plans

This is the closest thing crypto has to a Bloomberg Terminal. It offers real-time prices, market caps, circulating supply, and historical snapshots.

If your model needs up-to-date metrics or coverage across thousands of coins, start here. The free tier is generous enough for most projects.

Dataset Spotlight (click to expand)

dataset_name: CoinMarketCap API type: Crypto Market Metrics access: Free tier (commercial use allowed) + Paid plans format: JSON API ideal_for: Volatility tracking, market cap analysis, DeFi metrics notes: Generous free tier with global token coverage

12. Cryptocurrency Historical Prices

Access: Free (check dataset-specific terms)

A starter pack for crypto forecasting. Bitcoin, Ethereum, and others — complete with daily OHLCV and trading volume.

It’s great for training basic LSTM models or comparing tokens over time. But be warned: this is exchange-level data, not blockchain-level detail.

Access: Free + Premium (commercial use may require paid plan)

Looking for normalized data across multiple exchanges? CryptoCompare does the heavy lifting — aggregating, cleaning, and formatting price data for spot and derivative markets.

It’s especially useful when training models that need consistent structure across assets or time zones.

14. Glassnode (on-chain analytics)

Access: Free dashboards; Paid API license for commercial use

This one’s for when you want to go deeper — into wallets, addresses, transaction velocity, and network health. Great for behavioral modeling, anomaly detection, or building smart alerts that trigger when whales move. Just note: the real insights come with a price tag.

15. Ethereum Etherscan Dataset

Access: Free (public domain usage allowed)

Raw blockchain data — gas prices, contract interactions, token transfers — all parsed and downloadable. Ideal for training models that analyze transaction networks, wallet clusters, or DeFi protocols. It’s not clean out of the box, but the detail is unparalleled.

Alt-Finance & Research-Grade Datasets

This is where things get niche, complex, and incredibly valuable. These datasets go beyond prices — capturing text, sentiment, ESG, recommendations, and even reasoning chains. Perfect for building multi-input models or testing LLMs in financial settings.

16. FNSPID (News + Stocks Multimodal)

Access: Free for research (CC BY‑NC; academic use only)

29 million stock price records + 15 million news headlines = one powerful training set. Ideal for models that combine numerical and textual inputs — like transformers that predict price movements based on headlines or event-driven anomalies.

Dataset Spotlight (click to expand)

dataset_name: FNSPID type: Multimodal Financial Dataset access: Free for research (CC BY-NC; academic use only) format: Tabular + Text (CSV + JSON) ideal_for: Headline-to-price modeling, transformer fine-tuning, LLMs notes: Time-aligned text and price data; academic license only

Access: Free (academic use; commercial license TBD)

This one’s a research gem. A standardized benchmark of 36 datasets spanning tasks like information extraction, question answering, sentiment analysis, and risk modeling.

It’s made for training and evaluating financial NLP systems — and it’s structured enough to plug directly into transformer pipelines.

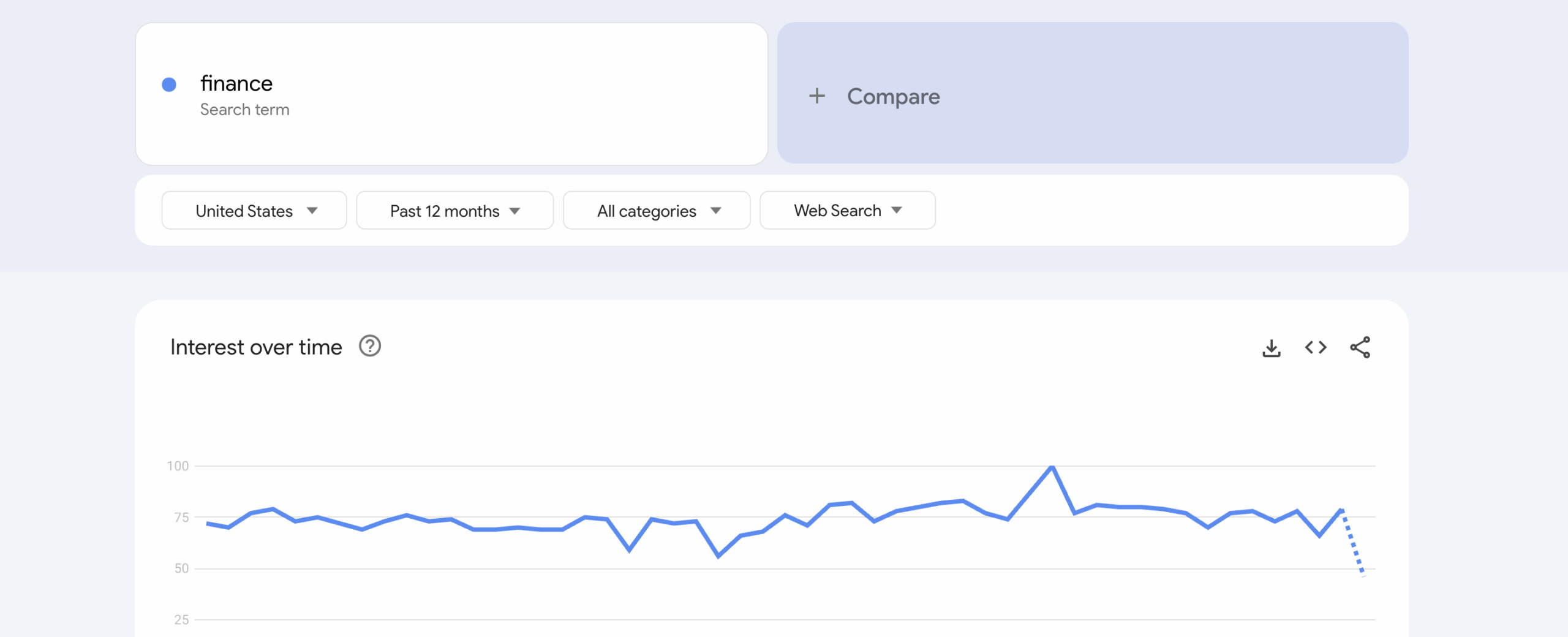

18. Google Trends – Financial Topics

Access: Free (commercial use allowed)

How often people search “market crash” isn’t just trivia — it’s signal. Google Trends tracks interest over time, giving your model a window into investor psychology.

Use it as a sentiment proxy, an external feature, or part of a multimodal stack.

19. FinMultiTime

Access: Free for research (check license in arXiv repository)

This is next-level multimodal. It includes news articles, stock tick data, candlestick charts, and tabular company data — all synchronized across time. Perfect for training foundation models or building “reasoning” agents that simulate decision-making under uncertainty.

20. EUROFIDAI – ESG & Event Finance

Access: Academic access (often via subscription)

For those working on sustainable finance, corporate behavior, or event-driven trading, EUROFIDAI offers high-frequency European data on firm actions, ESG disclosures, and more.

It’s clean, structured, and packed with real-world financial signals. Especially strong for event detection tasks.

Final Takeaways

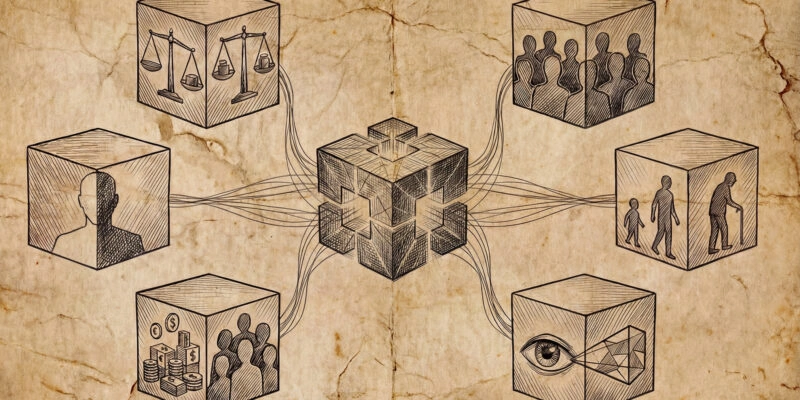

Financial data isn’t just numbers — it’s behavior, risk, emotion, and value in motion. The right dataset doesn’t just improve your model’s accuracy — it shapes what the model sees as reality.

Whether you're building a price predictor, a credit scoring system, or a market-aware LLM, the real edge comes from curated, relevant, high-signal data. Use this list as a launchpad — but always stress-test your sources.

Because in finance, assumptions get expensive fast.

📄 Dataset Cheat Sheet (Structured Recap)

Click to view all 20 datasets with access types

- dataset_name: Yahoo Finance – S&P 500

type: Market Data

access: Free (commercial use permitted)

format: CSV via yfinance

ideal_for: Price modeling, trend detection, LSTM training

- dataset_name: Alpha Vantage API

type: Financial Time Series

access: Free tier (commercial use) + Paid

format: JSON API

ideal_for: Automated ingestion, intraday or multi-asset modeling

- dataset_name: Quandl – Core US Financials

type: Equities, ETFs, Options

access: Freemium (check terms for commercial use)

format: CSV / API

ideal_for: Fundamental analysis, quick prototyping

- dataset_name: Google Finance via yfinance

type: Stock Data Proxy

access: Free (commercial use allowed)

format: Python wrapper

ideal_for: Quick tests, academic use, exploratory modeling

- dataset_name: Global Financial Data (GFD)

type: Historical Markets

access: Paid / Academic license

format: CSV / Excel

ideal_for: Long-range backtesting, deep historical trends

- dataset_name: FRED

type: Macroeconomic Indicators

access: Free (commercial use permitted)

format: CSV, JSON API

ideal_for: Forecasting inflation, employment, macro trends

- dataset_name: World Bank Open Data

type: Global Socio-Economic

access: Free (CC BY commercial use permitted)

format: CSV

ideal_for: Development modeling, country-level comparison

- dataset_name: IMF IFS

type: International Finance

access: Free (register; CC BY, commercial use permitted)

format: CSV

ideal_for: Currency, reserves, public debt, crisis signals

- dataset_name: OECD Public Finance

type: Tax & Fiscal Data

access: Free (commercial use permitted)

format: XLS/CSV

ideal_for: Sovereign risk, policy impact, EU-specific models

- dataset_name: EU Open Data Portal

type: Regional Economics

access: Free (comm. allowed under EU OGD License)

format: CSV / RDF

ideal_for: Subnational modeling, funding analytics

- dataset_name: Kaggle Crypto Prices

type: Historical Crypto OHLCV

access: Free (check individual dataset terms)

format: CSV

ideal_for: Crypto forecasting, token comparison, basic LSTM

- dataset_name: CoinMarketCap API

type: Crypto Market Metrics

access: Free tier (commercial use) + Paid

format: JSON API

ideal_for: Real-time dashboards, market cap analysis

- dataset_name: CryptoCompare API

type: Multi-Exchange Crypto

access: Free + Premium (check terms for commercial use in free tier)

format: JSON API

ideal_for: Normalized pricing, volatility modeling

- dataset_name: Glassnode

type: On-Chain Analytics

access: Free dashboards + Paid API (commercial use requires license)

format: Charts + JSON API

ideal_for: Behavioral signals, whale tracking, alerts

- dataset_name: Ethereum Etherscan Dataset

type: Blockchain Transactions

access: Free (public domain usage)

format: CSV/JSON (manual export)

ideal_for: Smart contract modeling, wallet clustering

- dataset_name: Google Trends – Finance

type: Search Interest Time Series

access: Free (commercial use allowed)

format: CSV

ideal_for: Sentiment proxy, exogenous features, signal fusion

- dataset_name: FinBen Benchmark Suite

type: Financial NLP

access: Free (academic use; commercial terms TBD)

format: JSON/TSV

ideal_for: Text classification, QA, sentiment, risk modeling

- dataset_name: FNSPID (News + Stocks)

type: Multimodal Financial Dataset

access: Free (CC BY-NC academic use only)

format: CSV + Text

ideal_for: Headline-driven prediction, transformers, LLM training

- dataset_name: FinMultiTime

type: Multimodal Financial Dataset

access: Free (research; check arXiv for license)

format: Text + Images + Tabular

ideal_for: Foundation model pretraining, multimodal LLM

- dataset_name: EUROFIDAI ESG & Events

type: ESG & Corporate Events

access: Academic (paid subscription)

format: CSV

ideal_for: Event-driven models, ESG factor investing