Ever tried predicting the stock market with gut instinct alone? Spoiler alert: It doesn’t end well. The stock market is a chaotic, emotion-driven beast, and if you want your machine learning model to tame it, you need solid data—not just any data, but the right kind.

But don’t worry—we’ve got you covered. Below, we’ve rounded up the best stock market datasets for machine learning, sorted by purpose. Whether you’re tracking price movements, analyzing sentiment, or digging into financial fundamentals, these datasets will help your model make smarter, more informed decisions. Let’s dive in!

Time Series Forecasting Datasets

Time-series datasets are crucial for stock price prediction, as they provide historical price movements, trading volumes, and volatility patterns. These datasets help train ML models to predict future stock prices based on past trends.

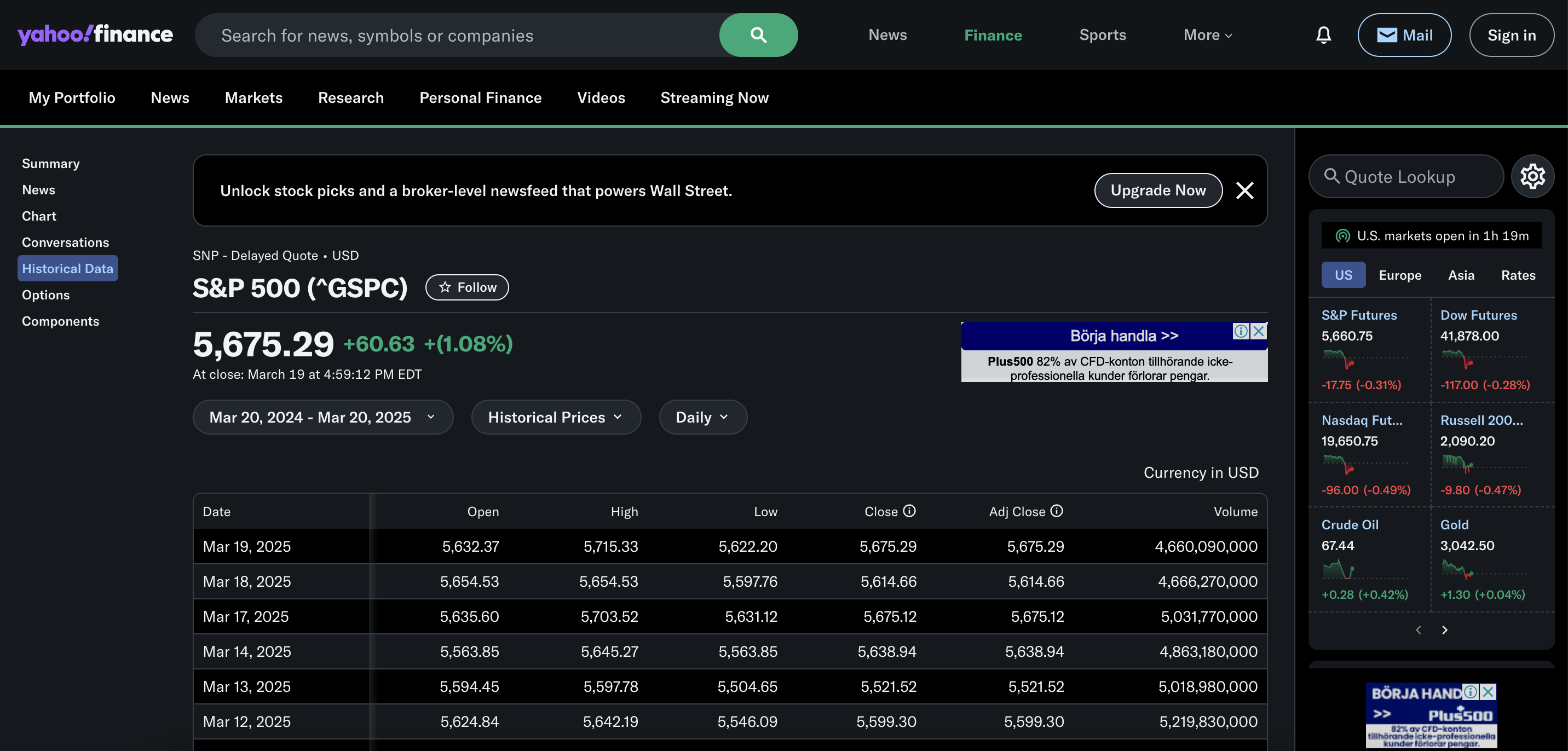

S&P 500 Stock Data from Yahoo Finance

This dataset includes daily Open, High, Low, Close (OHLC) prices and trading volumes for all companies listed in the S&P 500 index. It’s one of the most widely used financial datasets and is freely available, making it a great starting point for anyone building a supervised learning model for stock price prediction.

However, since it provides only end-of-day data, it’s better suited for longer-term trend forecasting rather than high-frequency trading.

Best for: Stock price forecasting, Portfolio backtesting, Long-term investment analysis.

Cryptocurrency Historical Data from Kaggle

This dataset includes historical OHLC prices, trading volumes, and market capitalization for over 20 major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Since crypto markets run 24/7 and are far more volatile than traditional stocks, this dataset is great for studying price trends, cycles, and market behavior over time.

However, it only provides daily data, which means it’s not the best fit for high-frequency trading (HFT) models that need real-time, tick-level updates. Also, crypto prices are heavily driven by news, regulations, and social media buzz—factors this dataset doesn’t cover. If you want more accurate predictions, pairing it with sentiment analysis or news-based features could give your model an extra edge.

Best for: Crypto price forecasting, Volatility analysis, and anomaly detection, Comparing traditional vs. crypto market behavior.

U.S. Treasury Yield Curve Rates from FRED

This dataset tracks historical U.S. Treasury yield curve rates, which are widely used to assess economic health and interest rate trends. Since inverted yield curves often signal upcoming recessions, this data is particularly useful for long-term stock market trend analysis and risk modeling.

That said, yield curves impact markets gradually, so this dataset isn’t great for short-term stock price prediction or day trading models. Also, while it’s a strong macroeconomic indicator, it doesn’t account for company-specific fundamentals or investor sentiment—so it works best when combined with other datasets like financial reports or market sentiment data.

Best for: Macroeconomic stock trend forecasting, Predicting recession-driven market movements, Risk assessment, and investment strategy models.

EUROFIDAI European Stock Market Data

This dataset provides daily stock prices, corporate events, and market indices from major European exchanges like Euronext, the London Stock Exchange, and Deutsche Börse. It’s great for analyzing European market trends or comparing them with U.S. stocks.

However, it’s not as detailed as order book data and lacks intraday price movements, making it less useful for short-term trading models. It’s best suited for long-term trend analysis and cross-market research.

Best for: European stock market analysis, U.S. vs. EU market comparisons, Long-term trend forecasting.

Intraday Stock Price & Order Book Data (LOBSTER)

LOBSTER provides high-resolution order book data for U.S. stocks, capturing millisecond-level bid-ask updates. It’s a must-have for building high-frequency trading (HFT) models, as it helps analyze market microstructure, liquidity changes, and price movements at the order level.

However, because it’s complex and extremely detailed, this dataset isn’t ideal for longer-term stock trend prediction. It also requires significant computational power to process the sheer volume of data. If you’re working on an HFT or algorithmic trading model, though, this dataset is one of the best ways to capture real-time market dynamics.

Best for: High-frequency and algorithmic trading models, Market microstructure and order flow analysis, Short-term price movement prediction.

CRSP Stock Database

CRSP is one of the most reliable sources for historical stock data, covering active and delisted stocks. Unlike free datasets, it ensures survivorship-bias-free data, which is crucial for backtesting trading strategies and long-term trend analysis.

Since it’s not real-time, it won’t work for high-frequency trading or short-term price movement predictions. But for historical research and realistic portfolio simulations, it’s one of the best datasets available.

Best for: Long-term stock trend modeling, Bias-free backtesting, Quantitative finance research.

Sentiment Analysis Datasets

Market sentiment plays a huge role in stock prices. Sentiment analysis datasets help ML models understand how public perception and news affect stock market movements.

Financial News and Stock Price Integration Dataset (FNSPID)

This dataset links millions of financial news articles with stock price movements, making it perfect for analyzing how news sentiment impacts the market. It allows ML models to detect patterns in how stocks react to positive or negative news over time.

However, since it focuses on historical news sentiment, it doesn’t offer real-time updates, which limits its use for high-frequency trading. For event-driven trading and sentiment analysis, though, it’s a great fit.

Best for: Predicting stock price reactions to the news, Training NLP models for financial sentiment analysis, Event-driven trading strategies.

StockNet Dataset

This dataset combines stock price data with sentiment analysis from Twitter, helping analyze how social media discussions impact stock movements. It’s especially useful for tracking retail investor sentiment and identifying hype-driven price swings.

Since it covers only two years of data (2014-2016), it may not reflect recent market dynamics, especially given how much retail investing behavior has changed. Still, it’s a great tool for studying past social sentiment effects on stocks.

Best for: Social media-driven stock prediction, Retail investor sentiment analysis, Exploring sentiment and price correlations.

Real-Time Online Stock Forecasting Dataset

This dataset integrates real-time financial news, TV transcripts, and social media data with stock price movements, making it one of the best choices for short-term stock trend prediction. It allows ML models to analyze market sentiment as it evolves and react accordingly.

However, since it focuses on real-time data, it requires frequent updates and strong computational resources to process continuously incoming information. It’s ideal for event-driven trading models but less useful for long-term trend forecasting.

Best for: Live stock price forecasting, Short-term trading based on sentiment shifts, NLP-based financial news models.

Reddit Financial News Dataset

This dataset compiles Reddit discussions on financial markets, capturing trending stock mentions and user sentiment. It’s particularly useful for tracking meme stocks and hype-driven market movements, which have become a major force in retail investing.

That said, Reddit sentiment alone isn’t always a reliable predictor of stock performance, as hype can fade quickly. For the best results, it should be combined with price data and traditional sentiment analysis.

Best for: Tracking retail investor sentiment, Meme stock prediction, Social sentiment-driven trading strategies.

Fundamental Analysis Datasets

Fundamental analysis datasets provide financial statements, economic indicators, and company fundamentals to help assess stock value based on intrinsic metrics.

SEC Filings and Reports from EDGAR

This dataset provides official filings from publicly traded companies, including annual (10-K) and quarterly (10-Q) reports, earnings disclosures, and financial statements. It’s essential for fundamental analysis and long-term investment models, as it contains detailed financial data that investors use to assess company performance.

However, since filings are released periodically, this dataset isn’t useful for short-term price prediction or real-time trading. It works best when combined with historical stock data to evaluate how financial fundamentals influence long-term stock trends.

Best for: Fundamental analysis of individual companies, Long-term stock valuation models, Comparing financial health across industries.

World Bank Global Financial Development Database

This dataset tracks global financial system indicators, including banking sector stability, financial inclusion, and credit market efficiency across multiple countries. It’s useful for macroeconomic stock analysis, helping ML models understand how financial development impacts market trends.

However, it’s not designed for individual stock predictions, as it focuses on broader economic trends. It’s best used alongside other datasets for sector-based analysis or country-specific financial modeling.

Best for: Macroeconomic forecasting, Country-level financial system analysis, Evaluating global financial stability.

OECD Economic Indicators

The OECD dataset provides economic indicators like GDP growth, inflation rates, unemployment, and trade balances. These metrics are essential for understanding macroeconomic conditions that influence stock markets, especially for sector-based investment strategies.

However, like other macroeconomic datasets, it doesn’t provide real-time or company-specific insights, making it less useful for short-term stock price forecasting. It works best for long-term market trend analysis and assessing the impact of economic cycles on stocks.

Best for: Macroeconomic stock trend forecasting, Sector-based investment models, Inflation, and recession impact analysis.

Banking Credit Default Swaps Data from BIS

This dataset tracks Credit Default Swap (CDS) spreads, which reflect the credit risk of banks and major financial institutions. Since rising CDS spreads often signal financial distress, this dataset is valuable for predicting banking crises and systemic market risks.

However, CDS spreads don’t always move in sync with stock prices, so they should be used alongside other financial indicators for a more complete risk analysis. This dataset is especially useful for stress-testing market conditions and identifying potential downturns.

Best for: Financial risk modeling, Predicting banking sector instability, Market stress testing.

Final Thoughts

The stock market is driven by more than just numbers—it’s influenced by sentiment, macroeconomic shifts, and even satellite imagery. The key to building a successful ML model isn’t just finding a good dataset; it’s about combining the right mix of datasets.

- For price prediction? Use S&P 500 Stock Data or CRSP Stock Database.

- For sentiment analysis? Try StockNet or Financial News and Stock Price Dataset.

- For economic insights? Check out SEC Filings or OECD Economic Indicators.