Challenge

One of the biggest banks in Eastern Europe aimed to automate call categorization in their call center for queries on debit cards, credit, deposits, and balances. Due to the sensitive nature of the data, strict privacy and transparency protocols were required.

Solution

Data Privacy & Compliance:

Given the sensitive nature of banking data, Unidata prioritized data security and transparency from the outset. All annotation was performed by our in-house specialists, each bound by strict non-disclosure agreements (NDAs).

To maintain client confidence and ensure comprehensive oversight, we structured clear reporting and communication protocols. This included:

- Group Channels: Dedicated group chats facilitated seamless communication and swift issue resolution, ensuring that all team members were aligned with privacy guidelines and annotation standards.

- Weekly Reporting: Project mentors submitted weekly reports detailing progress, challenges, and any adjustments made to the annotation criteria. These reports provided the client with regular updates while allowing Unidata to track productivity and improve efficiency.

- Coordination with Legal & Technical Teams: Unidata’s legal and technical departments were consistently involved to ensure every aspect of the project met high privacy and operational standards. This setup allowed for swift handling of any legal or technical adjustments required as the project progressed.

Annotation & Validation:

Our approach to annotation included precise categorization and extensive quality checks to guarantee high accuracy and relevance in the training data:

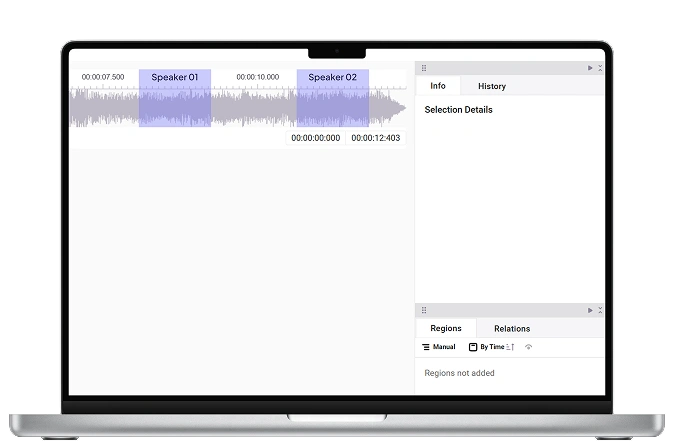

- Initial Annotation: Each audio file was carefully categorized by trained specialists based on query type (debit, credit, deposits, or balance), following specific guidelines provided by the client. Key elements, such as query wording and intent, were meticulously examined to capture the nuances of customer queries.

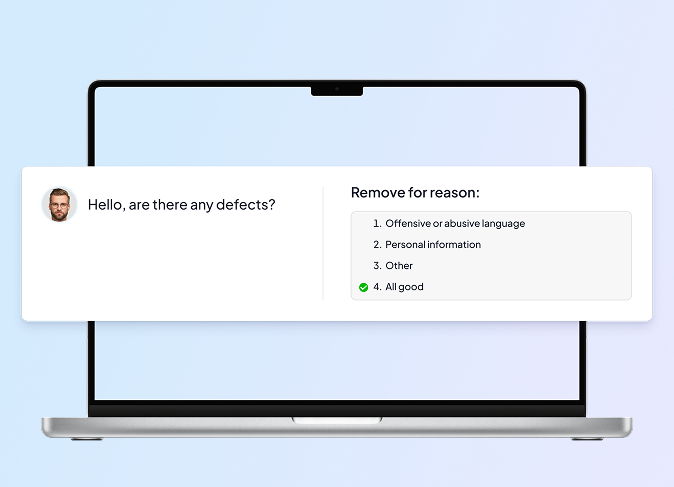

- Primary Validation: Annotated data underwent an initial review to identify potential discrepancies or inconsistencies, helping refine criteria and enhancing reliability.

- Cross-Validation: To mitigate subjective variations, multiple validators independently reviewed sample data, then compared results to standardize the approach. This cross-validation step ensured that all categories aligned with the bank’s requirements, improving consistency across annotations.

- Performance Monitoring: Real-time feedback mechanisms enabled the team to monitor individual and collective performance, track the productivity of annotators, and highlight areas for improvement. Regular feedback and guidance sessions were held to keep the team aligned with project goals.

- Ongoing Quality Adjustments: In partnership with the client, Unidata held regular check-ins to fine-tune annotation processes and incorporate feedback. These sessions allowed us to make timely adjustments based on real-world challenges observed in annotation and validation.

Result

- With our annotated data, the client trained a neural network achieving 96% accuracy for deposit queries, improving call center efficiency by 27%.